As an example, if you want to remodel your cooking area, you can Park Ridge kitchen remodeling begin with refinishing or painting the cupboards. Conserving up for paint will certainly be less complicated than conserving up for a complete makeover task, as well as it's a rather easy work that most individuals will feel confident doing. Hopefully, the painted or refinished cupboards will certainly help improve the cooking area enough so you can stand to prepare in it while you save up for even more renovation work. If you determine the repair work are required, you need to look around for the best deal on a contractor, as well as established a firm allocate the repairs. Stay clear of dipping right into your borrowed funds for anything apart from your required fixings. The first inquiry to ask on your own is if you actually need to make the changes now.

- Rather, you're able to attract funds from this credit line several times, implying you only need to pay passion on the section of your HELOC in operation.

- Have a look at all of your monthly expenses and think about decreasing unnecessary regular monthly costs to liberate some cash money to help pay for your residence enhancement project.

- For instance, if you owe $200,000 on a home worth two times as much, you can secure a funding for $300,000, changing the previous car loan and also getting cash money back at closing.

If you already have a mortgage you 'd continue paying its month-to-month settlements, while also paying on your new home equity loan. A house equity funding enables you to obtain versus the equity you have actually accumulated in your house. Your equity is computed by assessing your residence's value and deducting the outstanding debt on your existing mortgage loan. FHA 203 rehab finances are excellent when you're purchasing a fixer-upper as well as know you'll require funding for home enhancement jobs soon.

Conserve Up And Also Pay Cash.

The settlement is a fixe amount for a specific number of years, normally 20 to thirty years, for a house equity financing that requires a minimum of 10 percent equity in your home. A house equity loan is one more option you can utilize to repay your washroom remodel.

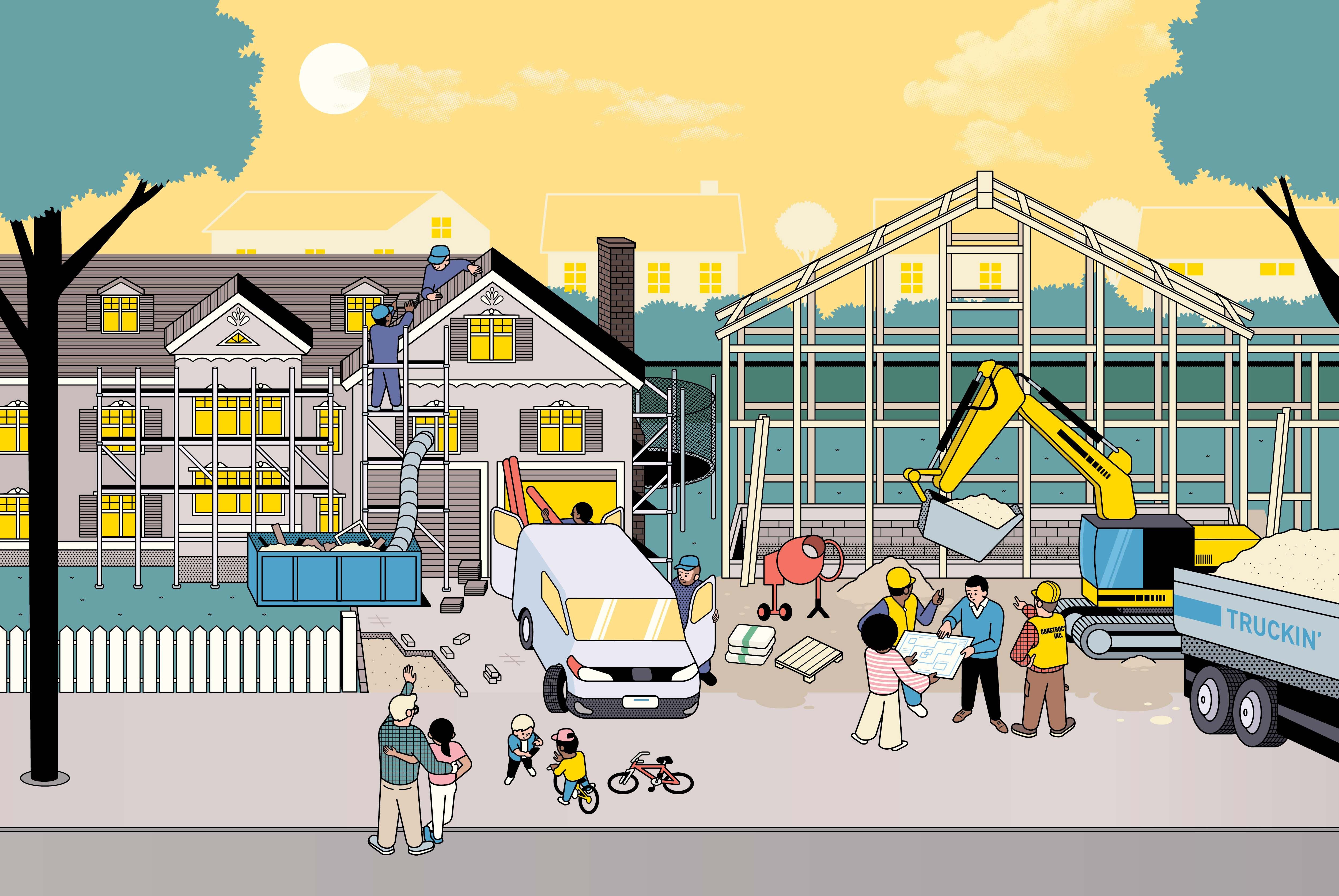

Take a look in all of your regular monthly expenses and take into consideration minimizing unnecessary monthly expenses to maximize some cash to help spend for your home renovation task. It may likewise be wise to include a little extra right into your spending plan because unexpected costs can appear while the job is underway. Maybe you have actually been considering remodeling your washroom or including an outdoor patio to your backyard for enjoyable family and friends. Residence improvements like these are exciting projects that can boost your lifestyle. With cautious planning, research as well as fast access to funding, you might make your house remodelling dreams come to life. It's additionally worth noting that kitchen remodeling Mount Prospect just because you can obtain a significant remodelling lending, does not imply you should.

Constantly consider your plan for repayment and the possibility for unexpected conditions to derail monetary strategies prior to moving ahead with significant restorations. When funding a house remodelling or recovery, you can make use of bank card, obtain a rehab loan, use a HELOC, and much more. Assume very carefully prior to spending for residence improvement projects with money, particularly when this might be appearing of lasting or emergency situation savings. Numerous personal fundings featured origination costs of in between 1% and 6%, adding further prices. A lot of house owners shouldn't utilize an individual lending to pay for residence enhancements, however it's important to understand they're often considered without recognizing it, at least initially.

Financial institutions, credit unions, broker agent homes, as well as money business all market these fundings aggressively. Line of credit, charges, and also rate of interest differ commonly, so store meticulously.

Cash.

Points are passion paid in advance, and also they can lower month-to-month repayments. Yet if your credit report is much less than perfect, you'll probably need to pay points just to get the lending. The Climb is a solution that ranks and also assesses essential products for your daily money issues. If interest rates are on the increase, decide if you can wait to redesign. The perfect loan provider for you will use the lowest rates of interest and the best terms. Find the best funding for your residence remodel before you begin knocking out wall surfaces-- your pocketbook will thanks. There's no reason to undergo the problem of funding a remodel if you're worried concerning making regular monthly https://penzu.com/p/e8205b8b repayments.

The worst instance circumstance for a HELOC interest rate is to be around as high as a credit card, around 18 percent interest, she says. 2 common means to finance house improvements are a house equity car loan, and a home equity line of credit, additionally called a HELOC. Both call for having some equity in your house, usually at least 10 percent.

Nonetheless, if you do not have enough equity or your credit score is uninspired, you may locate it hard-- or impossible-- to get a finance in the quantity you need. Unlike bank card debt or an individual lending, a house equity mortgage is safeguarded financial obligation, which implies rates are commonly considerably reduced. A lower financing charge has the prospective to greatly minimize the general price of a project, over time.